Gift Aid Management

For Faith-Based Charities

We give back over £200,000 in Gift Aid income to faith-based charities each month and provide peace of mind by managing their HMRC audits.

We keep a 4-year accounting period open at all times, allowing us to claim Gift Aid retrospectively and significantly increase your charity’s income.

Having processed over 1.6 million donations since 2010, we are the UK’s no.1 Gift Aid Management company for faith-based charities.

Submit an enquiry and find out how we can help you.

HMRC-registered Software Supplier

GoodtoGive is HMRC-registered, providing reliable software to file charity repayment claims online, helping you streamline the process.

Did you know that nearly £600 million in Gift Aid income goes unclaimed every year?

Be Ready for HMRC

We understand the daunting task of managing Gift Aid declarations and the stress associated with the potential for audits. Our services are designed to not only streamline the submission process, but also help your organisation be audit-ready. Not only that, but if you are audited we’ll manage the entire audit process for you.

Avoid the risk of repaying Gift Aid with interest or the consequence of being barred from claims altogether. Let GoodtoGive take care of the intricacies of HMRC compliance, so you can focus on what truly matters – your charity’s mission.

Multiply your Income by Claiming Retrospectively

By offering a retrospective claiming service for donations, we can process your backlog of donation information, be it spreadsheets, journals or envelopes, and integrate them into our secure online system.

This not only provides charities with a comprehensive and accessible history of their donations but is also an excellent avenue to receive a substantial lump sum of Gift Aid in a short period.

The real beauty of our unique Gift Aid software lies in its simplicity, turning what could potentially be a complex task into a seamless and headache-free experience.

4 Reasons We’re The Best Option

Efficiency

Once scanned into our system, there’s no need to keep your donation envelopes for audit purposes, as our digital records ensure accurate tracking and accountability.

Reduced Risk

Safeguard the reputation of both your trustees and your organisation with our professional services, and comply with best practices.

Convenience

If you are Gift Aid Audited by HMRC, we take care of the entire process for you, ensuring that all necessary documentation is in order and that you meet compliance standards.

Maximisation

We keep the 4-year claiming period open so all unclaimed donations are reviewed each time a new Gift Aid declaration is entered into the system.

Our Apps & Technology

GoodtoGive Mobile Apps

Through our suite of gift aid software, we streamline the church management process to work in seamless conjunction with the GoodtoGive client portal.

Through our suite of gift aid software, we streamline the church management process to work in seamless conjunction with the GoodtoGive client portal.

Our software for charities allows for management of the following activities:

✓ Setup Donation Projects using our GoodtoGive Church Management App

✓ Receive donations via our GoodtoGive Church Member App – we can process your gift aid

✓ Create events and store in your members diaries

✓ Organise your volunteers using Tasks

✓ Members can run reports on their donations

✓ Church administrators can run reports on their donation projects

Boost Gift Aid With Donation Maximiser

In today’s digital landscape, managing Gift Aid effectively is crucial for maximising donations and ensuring that every possible penny is claimed to support important causes.

With Donation Maximiser, we set out to design gift aid software which would change the way this benefit is processed forever. At the heart of our service, its massive computing power is used to maximise your claims. The result is more gift aid in your hands to do God’s work.

By leveraging advanced algorithms and user-friendly interfaces, our innovative software simplifies the claim process, reduces administrative burden, and enhances accuracy.

Whether you’re a small charity or a large non-profit organisation, Donation Maximiser is engineered to help you make the most of Gift Aid effortlessly.

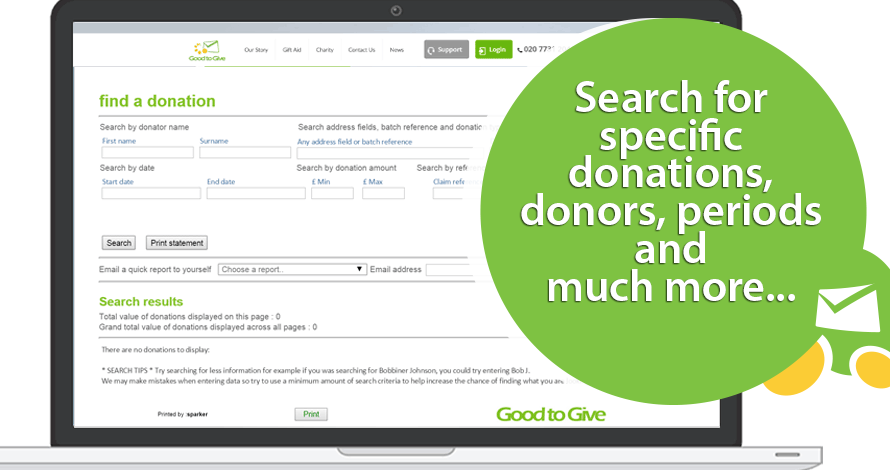

Our Client Microsite

How Our System Can Help Faith-Based Charities

Declarations are the key to a successful gift aid claim.

Declarations are the key to a successful gift aid claim.

They are the contract between the donors and HMRC which is why we treat them with care.

Each one is converted into a digital equivalent so it can be quickly retrieved or matched to a donation.

Our innovative system electronically delivers your claim directly into HMRC’s computer system, eliminating the need for manual processing.

This streamlined approach not only ensures accuracy but also massively accelerates the entire process, significantly reducing the time it takes for your claim to be approved and paid.

The advantage to you is simple. Every donation which has not been claimed on in the past 4 years is checked each time a new Gift Aid declaration hits the system to see if we have any previous donations from that donor. The same thing also happens if a new donation hits the system.

Why is this important?

Why is this important?

Donors may visit your charity multiple times in a year, making donations but not completing a gift aid declaration.

In most cases these envelopes will be disposed of, prohibiting a gift aid claim. Gift aid software ensures that this is correctly logged allowing for a successful claim further down the line.

Using our service all donations are scanned indexed and stored.

Let’s say the donor returns 2 years later and completes a gift aid declaration. Overnight, Donation Maximiser will match their donations to the new declaration and add it to your current balance waiting to be claimed.

Empowering your senior team is key to making gift aid successful.

Empowering your senior team is key to making gift aid successful.

The more everyone knows about the issues and successes, the more inspired everyone becomes.

We send out a useful reports to ensure everyone is kept in the loop.

‘Count it, Write the amount on it and Scan it’.

Gift aid envelopes can be scanned so you don’t have to store them. Save time avoiding transcribing your donations into your accounting system or spreadsheets.

Gift aid envelopes can be scanned so you don’t have to store them. Save time avoiding transcribing your donations into your accounting system or spreadsheets.

Our gift aid software keeps all your data in a centralised location where it can be easily accessed in the future or when needed.

Our service keeps all your gift aid data safe.

Donations are taken using our specially designed gift aid envelopes.

Donations are taken using our specially designed gift aid envelopes.

Your regular members are given a membership number which acts as their gift aid reference number.

Staying in regular touch with your members is an important way to spread your message and grow your membership.

Staying in regular touch with your members is an important way to spread your message and grow your membership.

Email marketing is an add-on to our service which enables you to schedule personalised emails to be sent out weekly, monthly, quarterly and yearly to your members and/or visitors.

Every personalised email contains your logo, message, a list of your top 5 events and an unsubscribe option.

Although many charities rely on donations as their primary source of income, many do not take advantage of the internet to promote their message and raise funds.

Our add-on fundraising events page allows you to easily create web pages for your charitable activities. Think of a unique name for your event web-link, fill in the form and off you go. All your web pages will look great and more importantly have a Donate and or Registration button.

Our add-on fundraising events page allows you to easily create web pages for your charitable activities. Think of a unique name for your event web-link, fill in the form and off you go. All your web pages will look great and more importantly have a Donate and or Registration button.

Depending on your preference you can use our domain name:

eg. www.goodtogive.co.uk/youreventname

If we spot any errors whilst processing your donations we can make them available to you via your personal login with notes explaining the issues.

If we spot any errors whilst processing your donations we can make them available to you via your personal login with notes explaining the issues.

You can make the corrections electronically and pass it back to us for processing. This is one of the leading benefits to our gift aid software and has the potential to save you weeks in waiting times.

Many charities justifiably have real concerns about their readiness to undergo a HM Revenue & Customs audit.

Many charities justifiably have real concerns about their readiness to undergo a HM Revenue & Customs audit.

An unsuccessful audit could mean having to repay your claim plus interest, prevent you claiming on the Gift Aid Small Donations Scheme and increase the change of further audits in the future.

This is why we manage Audits for all our premium clients. This is just one of the services we offer through our software for charities suite.

Maximise your Donations and Connect Your Community

In this digital age, connecting with your community and optimising donations has become remarkably straightforward.

Our mobile apps are tailored specifically for churches looking to enhance their fundraising efforts and strengthen member engagement through innovative solutions.

Instant Giving: Empower your congregation to make quick donations with just a few taps on their mobile devices, anytime and from any location, guaranteeing that your church benefits from ongoing support.

Boost Community Involvement: Featuring tools designed to promote greater interaction, our app allows you to keep your members updated and engaged, nurturing a deeper sense of community and involvement.

Never Lose a Penny of Gift Aid Again

GoodtoGive’s system relentlessly pursues the claim of Gift Aid on donations, operating within the 4-year retrospective claim period set by HMRC. Donations are never discarded until every avenue has been thoroughly explored.

To ensure transparency and cooperation, our innovative church accountancy software and collaborative system keeps you updated, highlighting urgent issues that demand your attention. This way, we ensure that any church donation with potential for gift aid does not slip through the cracks.

Reduce the Risk & Preserve your Reputation

We understand that often finances are limited and your charity has to rely on volunteers. However in financial matters that are governed by regulation, like Gift Aid, it’s best to hire a professional. Your volunteers might be great, but do they fully understand the ins-and-outs of maximising Gift Aid?

If not, your charity could be missing out on much needed income and your Trustees could be being put at risk, through no fault of your volunteers but simply because they don’t know what they don’t know.

Our Gift Aid Management process is seemless and transparent, so your members and HMRC can access a full audit trail at anytime. With our support, your organisation can stay focused on driving its mission forward, while we keep Gift Aid contributions coming in. This way, GoodtoGive empowers charities to maximise their impact without the distraction of administrative hurdles.

GoodtoGive delivers a complete solution:

- We maximise your donations so you receive the maximum amount of Gift Aid you’re entitled to.

- Each time a new declaration is received we will scan any unclaimed donations spanning the past 4 years for a match. This feature can significantly increase your claim levels.

- Mobile Apps to simplify your donation management, Gift Aid processing and more.

- Specially designed envelopes to capture valid donations and Gift Aid declarations.

- Should you be audited by the HMRC you have rapid access to any requested information.

- Reduce the risk of lost or damaged declaration forms or envelopes.

- Remove the effort associated with storage and retrieval of paper documents.

- Reduced Treasury workload.

- Create automated communication to your members thanking them for their donations, reminders about your events and Gift Aid requirements.

Have any questions?

020 7731 2041

Find us at:

GoodtoGive, Office 116, Bizspace Business Centre, 4-6 Wadsworth Road, Perivale, UB6 7JJ